Step Into a New Era in Banking Leadership

Enhance your bank's competitive edge and client relationships through expert business advisory services.

Drive Growth

Strengthen Relationships

Lead Effectively

Opportunity in the Market

There is opportunity for Your Bank to further differentiate itself with business owners.

We are at a unique point in history*.

Achieve Strategic Growth and Differentiation

With the right guidance, your bank can evolve into a trusted advisor for business clients. This transformation not only enhances client relationships but also positions your bank as a leader in the market. Success in this venture leads to sustainable growth and increased loyalty among business clients.

A Comprehensive Approach to Advisory Services

Third Act offers a structured, phased approach to help banks like yours successfully integrate business advisory services. From readiness assessments to market strategies and ongoing support, we provide the expertise and resources necessary for your success.

Your Partner in Banking Transformation

At Third Act, we understand the complexities of banking operations and the challenges of implementing change. Our team of experts is committed to guiding you through each step of enhancing your advisory capabilities, ensuring your bank not only adapts but thrives.

Simple Steps to Superior Advisory Services

Step 1:

Consultation Call

Have a brief exploratory call to evaluate your bank’s current capabilities.

Step 2:

Analyze Opportunities

Develop a framework to assist existing business customers and target prospects.

Step 3:

Implement Strategies

Craft and execute a tailored go-to-market strategy for Your Bank.

All The Tools You Need to Be Successful

We educate your bankers in advance of customer/prospect education. We then educate your customers and prospects with your bankers as the hosts. Presentations are in-person (Live), webinars, and workshops.

What we do does not disrupt your current efforts, this works alongside and enhances your current efforts.

Banker Launch (Live)

Banker-Only Webinar Training

Customers, Prospects, Advisory Board and Bankers ("CPAB") Launch (Live)

Customers, Prospects, Advisory Board and Bankers ("CPAB") Webinar Training

Center of Influence "COI") Sessions

The Freedom Workshop (Live)

Realize the Advantages of Superior Advisory Services

By collaborating with Third Act Consulting, your bank will:

- Strengthen client relationships through enhanced service offerings

- Position itself as a leader in business advisory services

- Attract and retain high-value business clients

- Benefit from ongoing expert support and peer networking

- Increase overall bank growth and profitability

Start your journey to become a leader in banking advisory services today.

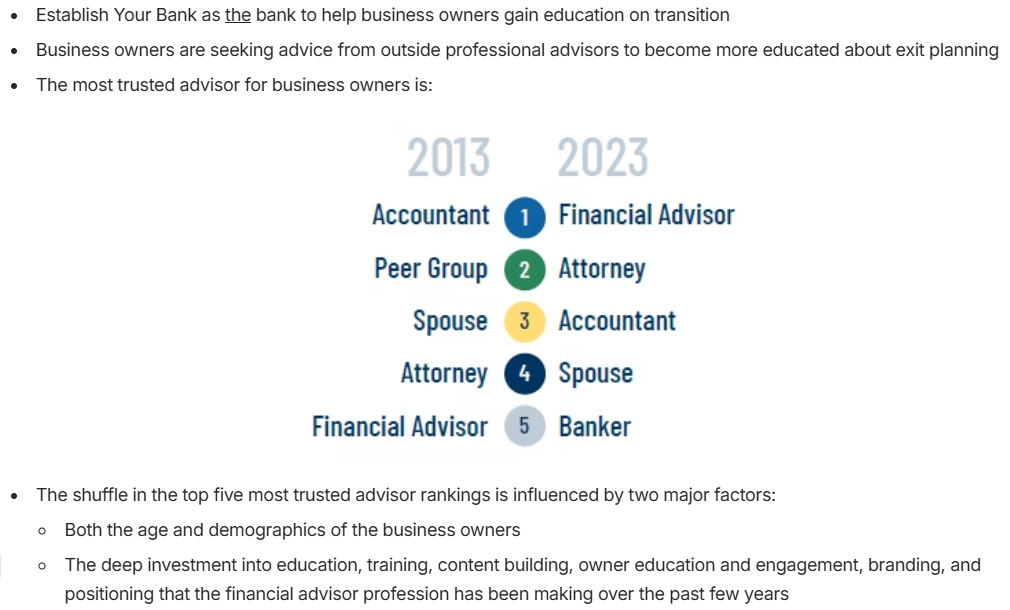

Who Do Business Owners Turn to for Building Value?

Business owners are having these conversations, but business bankers are near the bottom of the list.

What are the risks and opportunities for your bank?

Why is it crucial for banks to focus on C&I relationships?

How do I know if my bank is ready to offer business advisory services?

How does Third Act tailor its consulting to fit different banks?

What is the client onboarding process like with Third Act?

How does Third Act maintain relationships with clients after initial set-up?

Proof of Our Impact in the Banking Sector

Ned Miller

Ned Miller is the founder of 3rd Act Consulting, which provides individual and group coaching to bank sales leaders on assessing and developing their teams to improve sales performance. He works with Executive Management, line of business heads and team leaders in the following areas:

Evaluating sales skills of team members

Recruiting, onboarding and orienting new sales leaders

Assessing the sales leadership potential of current team members

Developing and implementing individual coaching plans to improve business development results

Before entering consulting, Ned was a teacher and coach at The Lawrenceville School and a relationship manager and team leader at Citibank and at the Philadelphia National Bank. After eight plus years in banking he joined Richardson and deliver sales and negotiating skills training to bankers in the US, Canada and Latin America. He became convinced that the key to improving sales performance was coaching from first-line sales managers. Ned spent 10 years at RMA where he developed conferences and training programs on small business, real estate, workouts and private banking.

He partnered with Buck Bierly at MZ BIERLY CONSULTING, INC. for over 20 years to improve the effectiveness of sales teams in community and regional banks. He is a frequent speaker at banking conferences and has published numerous articles in banking publications on sales and sales leadership.

Jim Huerth

With nearly 40 years of experience in the financial services industry, Mr. Huerth first joined AmeriServ as the chief commercial banking officer. He has held multiple roles in the company, including chief banking officer and president and CEO of AmeriServ Financial Bank. He served as president and CEO of AmeriServ Trust and Financial Services Company, and as president and CEO of West Chester Capital Advisors, a wholly owned subsidiary of AmeriServ Financial Bank; a subsidiary of AmeriServ Financial, Inc. Mr. Huerth holds Bachelor of Arts degrees in both economics and business management from North Carolina State University. He has served on the board of directors for the United Way of the Laurel Highlands, the Enterprise Venture Capital Corporation, the Leukemia and Lymphoma Society, McLanahan Corporation, Tranquility Gardens, and the Johnstown Industrial Development Corporation.

Kurt Knutson

Kurt Knutson was a commercial banker for 40 years. For almost ten years, Knutson was trained in and worked in capital markets and corporate finance. Thanks to that background he was able to organize and lead a group of local businesspeople to raise capital for a bank he founded in 2005. The de novo bank opened in suburban Kansas City in 2006, grew to approximately $250 million in assets and successfully sold in the fourth quarter of 2022. Knutson was appointed by Kansas Governor Sam Brownback to the State Banking Board in 2011 where he served until 2019. Knutson was elected by his peers as the Chairman of the Kansas Bankers Association in 2019 where he served through 2020. In 2023, Knutson wrote and published, "The Art of Selling Your Bank: A Bank CEO's Step-By-Step Guide." Knutson, through his brand Level 3 Freedom, offers 1-on-1 coaching to bank CEOs through a program titled, "Building a Coveted Community Bank, By Design."